The complete monitoring experience for your phone

Get XNSPY and start tracking calls, texts, multimedia, locations and more on any phone!

Get Started Now Live DemoIf you have a parent who’s part of the ‘baby-boomer’ generation, chances are they’re not as well-versed in technology as you. Whether this is a good or bad thing depends on your perspective.

The good news is that they probably aren’t addicted to their phones and social media like Millenials and Generation Z are. The bad news, however, is that they might be at bigger risk of online scams and fraud.

The world around us is becoming more digital and automated than ever before. Cybercriminals and scammers are finding sophisticated ways to target anyone. Even those who are literate in technology sometimes become victims.

So if you have parents who aren’t tech-savvy, this blog will help you identify scams and fraud to look out for.

Why the Elders Are Easy Target of Scams and Frauds

Elderly fraud is an increasing crime. Scams targeting seniors over 60 caused $3.4 billion in losses. Fraudsters tend to target seniors as they think they have sufficient money in the bank. However, even people with less income and savings are also vulnerable to the risks.

Financial scams can be hard on older adults, as most are left with no way to recover their losses. This includes money they may save for retirement, use for daily grocery purchases and utility payments, and even that they look to pass down to their family. The financial losses may also cause anxiety, depression, loss of appetite, and insomnia in your parents.

In our research, we noticed some common themes with crimes targeting the elderly and have laid out why they might be the perfect victims:

Trusting Nature

People of older generations tend to trust people more, a trait that the scammers exploit. They often hesitate to question authority from a person who seems friendly. This is why your parents might be susceptible to phone scams, where a fraudster may claim to be a person from a reputable bank or other institution.

Health Concerns

Memory loss and other forms of cognitive decline leave seniors with moments of forgetfulness and confusion. Scammers can easily use their physical weakness to manipulate them and make them make quick financial decisions without thinking.

Financial Vulnerability

Older populations are easy targets as most have money in the form of retirement funds, savings, and other assets. According to the Federal Reserve, the median retirement account savings for individuals between ages 55 and 64 is roughly $185,000.

Scammers target this considerable amount of money. Many older people fall victim to scams that promise to improve their financial situation or provide a miracle cure for their medical condition.

Social Isolation

Senior citizens live alone and are likely more at risk of depression and social isolation than you might be. Fraudsters may use fake relationships and emotional appeals to get intimate with them. Many seniors find this social connection appealing as they live lonely lives, but fraudsters only gain trust to exploit it later.

Less Likely to Report Scams

Many elderly individuals are less likely to report scams due to embarrassment, fear of losing their independence, or lack of knowledge about how to report a scam. Within nuclear or joint families, this problem is easily avoidable since many people can keep a direct eye on their phone activities. This allows scammers to target the same individual again or others in similar situations.

The Common Scams that Elders Face

Fraudsters and scammers use technology to exploit and run their schemes. Elderly individuals are particularly vulnerable to these scams that exploit their trust, lack of tech-savvy knowledge, and financial situations.

The first step to avoid fraud is recognizing the methods that may target the elderly.

Here is a list of common scams:

Medical and Health Insurance Scams

Scammers pose as healthcare providers or Medicare representatives. They usually call to collect their Social Security numbers and insurance details and use them for fraudulent billing and identity theft. Sharing a bank account and insurance might even put you, their caretaker, at risk.

Fake Lottery and Sweepstakes Scams

Scammers may call and tell your folks they have won a lottery, prize, or sweepstake. However, to claim their prize, they must pay taxes, fees, and shipping costs. In this activity, the fraudsters obtain personal details and credit card information to fulfill the claim. We advise reporting all such numbers to the relevant authorities, such as the FCC.

Investment Frauds

Scammers offer fake investment opportunities and phony schemes that promise high returns. They even convince them to move their retirement funds and savings into risky and non-existent investments.

Government Impersonation

Fraudsters will pretend to represent any government agency, such as Medicare, the IRS, or the Social Security Administration (SSA). They will contact the elderly, claiming money or unpaid taxes.

Tech Support Fraud

Tech support scammers often lure senior citizens with deceptive messages, calls, and pop-up warnings that their computer has a virus. They offer to fix the issue but ask for personal information, payments, and remote access to the computer. Once they gain access, scammers steal and exploit the information for money.

Grandparent Scam

Scammers will take a personal approach and pose as grandchildren or family members. They will call out in distress and say they need money to get out of their situation. The scammers first single out the elderly individual and research family names and information to earn the elderly person’s trust.

Email Scams

Fraudsters send emails and messages that appear to be from legitimate sources, such as banks, the IRS, or known companies. Older adults are asked to verify their personal information. Many do not verify the source of information and provide their details, which are then used for identity theft.

Prevent Scams with XNSPY’s Smart Monitoring

Stay ahead of scammers by monitoring your loved ones’ devices

Tips that Can Help Prevent Fraud on Elderly People

Most senior citizens become victims of fraud through some form of social engineering. It also may be due to their lack of tech knowledge, unawareness of the crimes, medical reasons, or making snap decisions. However, their children must care for them and guide them on ways to protect them from potential scams.

Here are some tips to consider that can help prevent fraud

- Educate your parents to identify common scams.

- Ask them not to share personal or financial information with anyone on the phone

- Suggest they sign up for online banking to review their account activity.

- Remind them to report any suspicious calls or emails they receive

- Arrange a joint bank account or view-only access so family members can monitor suspicious activity.

- Disconnect the internet and shut down the device if they see unusual pop-ups or activity.

- Ask them to use strong passwords along with reputable antivirus software.

How XNSPY Can Help Safeguard Elderly Against Fraud

According to the Social Security Administration, older adults suffering from Alzheimer’s and dementia are at a higher risk of financial abuse and scams. However, this does not undermine the fact that other adults are also at risk and active protections are needed to monitor and control these frauds.

Even if you guide them on the tips, there is no guarantee that fraud will not happen. Moreover, with a professional and personal life of your own, constantly keeping track of your parent’s online activity is quite challenging. To prevent scams, you need a monitoring app, such as XNSPY, to send you real-time updates and provide monitoring 24/7.

The app is already established in the monitoring industry and has positive reviews from several customers and critics. XNSPY can be a valuable tool for safeguarding elderly individuals against fraud by offering monitoring and alert features.

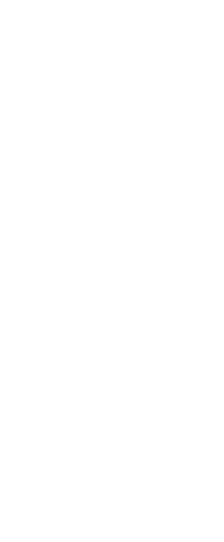

You only need to access the elderly phone once to install the app. After installation, the app will automatically gather all phone and app data and upload it to its servers. You can log in to the app’s dashboard remotely from anywhere to view the data.

Here’s how XNSPY can help protect seniors from scams and fraud:

Monitoring Unusual Phone Calls

XNSPY logs all incoming, outgoing, and missed calls, along with the contact name and number. If unknown callers repeatedly call, it can be a red flag for potential scam attempts The app’s call recording feature can further show if the scammer coerces the elderly to share personal or financial information.

Social Media and Instant Messaging (IM) Monitoring

Fraudsters tend to target adults through social media apps like Facebook and WhatsApp, knowing the adults are not that savvy. XNSPY can monitor up to 12 popular IM apps and provide all the chat details. It can help prevent adults from falling victim to romance scams, impersonation fraud, or phishing attempts.

Tracking Internet Activity

XNSPY tracks all the internet activity of the monitored device. This helps to identify the websites visited by the elderly person and detect whether they are visiting fraudulent or scam websites. If they are engaging with phishing sites or fake charities, you can step in to prevent fraud.

Email Monitoring

Email scams are one of the most infamous ways scammers might target older adults. XNSPY’s email monitoring feature can help detect phishing emails and block fraudulent requests for personal information. The app provides not only the contact’s name but also any attachment or link shared in the email.

Remote Access and Control

There are many instances where someone may unknowingly click on a suspicious link and download an app. You can use XNSPY to get a list of all the Installed Apps and block and remove any suspicious ones you recognize. If the device is compromised due to fraud, you can remotely wipe it and prevent scammers from using the information.

Alerts for Financial Fraud

With busy routines, tracking all the data on the elderly device can be difficult. XNSPY allows you to set specific words, contacts, and locations as alerts. If any messages containing those words or email contacts appear on the phone, you will be notified.

Location Tracking

If the elderly person is vulnerable to scams or is frequently moving outside, you can use XNSPY’s real-time SIM tracking feature to monitor their location. This helps ensure they are not visiting unknown places where they might be at risk of in-person fraud. You can also set up geofences for your parents and instantly get notified when they exit this pre-defined perimeter.

Conclusion

Scams targeting the elderly are becoming increasingly common. The losses seem to increase significantly each year, which calls for proactive preventive measures. Educating seniors about scams, using technology to protect their information, and keeping a watchful eye on their financial and online activities can create a secure environment for them.

XNSPY offers an effective solution by providing comprehensive monitoring tools to safeguard the elderly from fraud. Its ability to track phone calls, text messages, social media interactions, GPS locations, and online activities helps to detect suspicious behavior early and intervene before any scam occurs.

Use XNSPY to Fight Against Scams

Keep your family safe from scams with XNSPY’s reliable features.

5 Comments

Leave a reply:

Your email address will not be published. Required fields are marked*

Lucy S.

February 11, 2025 at 2:51 pmThis is concerning

Patricia F. Watkins

February 17, 2025 at 10:04 am👏

Ellis

March 5, 2025 at 11:20 amIt's not only the elderly but also the kids!

Joyce W. Eichler

April 7, 2025 at 2:39 pmThe world is full of evil people. It is upto us to protect our parents.

Mamie B. Lazar

April 14, 2025 at 8:25 amMy kind nonna ended up losing all her lifes savings like this